Retirement Math Simplified

If you want any hope of retiring comfortably, you need to have at least a basic understanding of advanced math.

Most of the soundbites today on retirement planning speak to people with limited knowledge of math. The basic message is “Put some aside today and in 30 years you will have riches!” So, you put some money into the black box known as your 401(k)/IRA/403(b) plan and assume that through some sort of magic it will generate lots of interest and dividends without you doing anything further. Sometimes that works and sometimes it doesn’t. When it doesn’t work, people scratch their heads and wonder why. See, for example, the following article:

- “Retirement savers’ confidence plummets,” MarketWatch, March 15, 2011.

It doesn’t seem to be just regular people who have difficulty with the math of long-term investing. Recently we have seen numerous professional investing plans fail due to miscalculations in this area. For example, Social Security, pensions, long-term care insurance, annuities, and prepaid college savings plans all rely on the same type of math—i.e. pay a little today in exchange for a big return tomorrow. And many of these plans have run into financial difficulty of late. See, for example the following news articles:

- “College Plans You Thought Were Safe,” Ron Lieber, The New York Times, April 1, 2011.

- Press release, “MetLife Will Discontinue the Sale of New Long-Term Care Insurance Coverage,” November 10, 2010.

- “Donors Find Gift Annuities Can Stop Giving,” The Wall Street Journal, May 12, 2009.

- “Falling Short: A Special Report on Pensions,” The Economist, April 7, 2011

The reasons for these professional failures is somewhat unclear but it seems to stem from underestimating the amount of contributions needed, underestimating future expenses and overestimating investment returns.

The same mistakes occur in our personal retirement planning calculations. This post will give you a quick, simplified overview of what these financial assumptions and calculations are and how they might impact your own retirement planning. It is very easy to get overwhelmed by the complexity and just give up on understanding any of it. But it doesn’t have to be that way. With a few simple ideas in mind, you are going to do a lot to steer yourself in the right direction.

The Most Conservative Strategy

If we strip out all the complicating factors of retirement planning (interest, inflation, taxes, salary appreciation over time, cost of living increases, etc.) and just go back to a simple example, we get a clear picture of how saving for your own retirement might work.

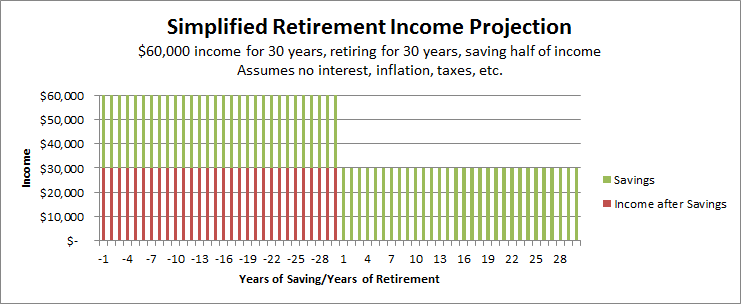

For example: A worker earns $60,000 per year and works 30 years, earning a consistent $60,000 salary per year. (Never mind, that in reality, you would probably earn less at the beginning of your career and more at the end.) Then the worker retires for 30 years and needs constant income. (Again, we are ignoring interest, inflation, Social Security and tax rates.) If the worker saves nothing during the working years, the worker earns $60,000 during the employed years and nothing in retirement.

If the worker wants to maintain the same standard of living in retirement, the worker would essentially need to live on half of his/her income during the 30 working years to have the same amount in retirement, as shown in the graph below.

Pretty simple to understand but pretty hard to implement in practice! Live on half your income? Really? Does anyone do this? If you have ever spent any time reading the comments on The Wall Street Journal website, you would know that there are quite a few people that practice this exact strategy. There is certainly nothing wrong with adopting this strategy and if you can do it, you are probably going to get through retirement just fine, assuming you are investing your savings wisely over time. For most people, however, this is too restrictive and conservative. To get better leverage of our money today, we rely on the benefits of compound interest.

The Least Conservative Strategy

The most positive factor working in our favor when it comes to saving a large amount of money is counting on compound interest. This means that not only is our money earning interest over time but the interest that we earn also earns more interest and the effect snowballs to make us a large sum in the end. Sometimes you see retirement planners get very aggressive with their assumptions on compound interest. The higher the interest rate and the more frequently it compounds (monthly, quarterly, annually, etc.) the faster your money grows. The New York Times recently published an interesting article on the topic of compounding, highlighting the fact that the last 10 years before your retirement are absolutely critical to reaching your retirement goals, because your money is supposed to approximately double in value over that time.

- “With Retirement Savings, It’s a Sprint to the Finish,” Tara Siegel Bernard, The New York Times, January 21, 2011.

So, now let’s assume that we want to receive approximately $30,000 per year in retirement and we are saving our money in something (stocks, bonds, CDs, etc.) that will earn us a minimum return of 4% per year. (Again, for simplicity, we are ignoring inflation, taxes, etc.) First, we need to know how much we need at retirement age to generate $30,000 per year at a 4% return. If we use this calculator putting in 30 years to retirement, 30 years in retirement, our desired annual income in retirement ($30,000), a return of 4%, compounded annually and 0% inflation, we see that we need almost $540,000 in retirement. ($539,511.44). You can play around with different interest rates and see what happens. If you could earn 8% interest compounded annually, you only need to save $364,752.18 but if your return is closer to 2% annually, you need a whopping $685,331.54.

So, then we need to find out how much we have to save each month in order to reach our savings goal. If you use this calculator and plug in starting with $0, 30 years to invest, 4% annual return and a future value (i.e. the amount you need at the end of your 30-year savings period) of $539,511.44 (the amount we calculated from the retirement calculator above), then click the “Contribution” button, you see that you need to be saving $784.73 per month! You can then click “View Schedule” to print out a guide that you can compare over time to make sure you are saving and earning interest on schedule. Note again, that if you change the interest rate to 8% you only need to save $380.58 per month and if you earn only 2% interest, you need to save $1096.40 per month.

$784.73 is still a lot to save each month, but it is far better than our “live on half your income” scenario. Under the 4% interest approach, you only need to save $9,416.76 per year rather than $30,000. So, if you are earning $60,000 per year, you get to live on over $50,000 per year rather than $30,000.

Cool! So now our income chart looks like this:

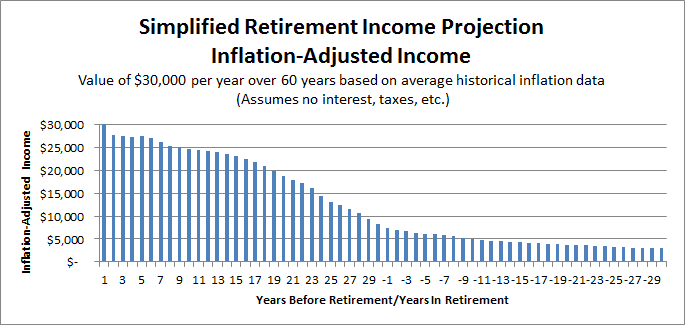

The Impact of Inflation

But, this again is not the complete story. This time we are too optimistic. Let’s factor in inflation. We will assume that your employer pays you $60,000 per year with no raises for 30 years. You stash $30,000 in a mattress each year for retirement. On retirement, you pull out $30,000 from the mattress each year to live on. What does inflation do to the buying power of your money over time? Using historical inflation rates from 1951 – 2010 from inflationdata.com, we see the following sad story.

So, what started out as $30,000, ends up being worth around $3,000 60 years later. Annual average inflation rates over the past 60 years range from -0.34% to 13.58%. The higher inflation goes, the less your money is worth.

You often hear people talk about “beating inflation” and what they mean is that you need to generate earning power each year that is at least equal to or better than inflation in order to keep the value of your money stable. In 2010, the average inflation rate was 1.64%, so if you didn’t earn a raise, your salary is now worth about 98% of what it once was. Similarly, if you had all of your money in savings accounts earning 1% interest, you also didn’t beat inflation and your money is now worth about 99% of what it was. NPR did a story recently about the impact of inflation and rising costs of living on employee incomes that is worth a listen.

- “Paychecks Can’t Keep Up With Rising Prices,” Marilyn Geewax, National Public Radio, April 10, 2011.

Yes, inflation is a confusing concept. Essentially, you could be losing money over time even though you don’t see actual losses on your bank statements. To prevent these losses, you need to have your money earn at least the rate of inflation each year. Averaged out, inflation has historically been around 3-4% so if you really want your money to grow, you need to generate investment returns more than that amount each year.

To see the impact of inflation, go back to our retirement calculator and instead of plugging in 0% inflation, leave the default inflation rate of 3.5%. Remember, before we needed to save $539,511.44 at 0% inflation. With 3.5% inflation, we need $2,357,666.76 ! Ouch! This corresponds to a monthly savings requirement of approximately $3,429.26 over 30 years. This is even more than the “live on half your income” strategy.

Now, before you completely panic at this point that saving for retirement is impossible, remember that 4% is a relatively low rate of return and 3.5% inflation is probably closer to the higher end. In recent years, inflation has been closer to 2%. If you earned an 8% return with 2% inflation that monthly payment goes down to about $565.78.

The Impact of Taxes

To add to the fun, you can calculate in tax rates. It is really your after-tax earnings that you live on, after all. Now you need to earn enough in retirement to compensate for whatever tax rates are. Nobody knows for sure what tax rates will be in the future. They probably would not be lower than 10% based on historical patterns and could be very, very high (hopefully not higher than 45% unless you are a very high income individual).

For example, if you assume you might be taxed at 33% (including federal and state taxes) on your $30,000 income in retirement, then you need to earn at least $30,000 * 1.33 = $39,900 each year. So, if we go back to our retirement planning calculator above and plug in 30 years to retirement, 30 years in retirement, 4% annual interest, 3.5% annual inflation (the default), and $39,900 (pre-tax income needed), we see that we now need to save $3,135,696.79 or about $4,560.92 per month. This ridiculous amount makes our “live on half your income” strategist look risky. This amount of savings would require you to live on about 10% of your income, which, I would like to see anyone but the most wealthy attempt.

Again, don’t assume that retirement is simply impossible. You can adjust the factors like rate of return, years to retirement, tax rates, income desired and inflation to get a lower monthly payment that is achievable for your situation.

The Reality

We all have to get comfortable with the large numbers of retirement planning and have at least a basic understanding of the factors like inflation and tax rates that have an enormous impact on our savings requirements.

While you can use the simple calculators profiled above to get a rough idea, you can also use more sophisticated calculators as well. Most every major financial advisor offers retirement planning calculator on its website. If you already have a 401(k)/IRA plan, you might check to see what your provider offers. These calculators have relatively simple inputs and allow you to play around with some of the variables. For example, here is one from Schwab and here is one from CNN Money.

Just be aware that all of these calculators are going to have some limitations. They are perhaps a bit optimistic when it comes to returns on your money (one I looked at had a minimum return of 8% and a maximum return of something like 20% annually) and they don’t seem to account for the fact that your income might vary dramatically over time and that you might be able to make more contributions at later points in your life when you have more income and fewer expenses than earlier on when you might be paying down debt or raising a family. If you have variable income or expect to make variable payments to your savings plan over time, you likely need to spend some time either crunching your own numbers or sitting down with a financial professional to work the numbers for you.

The Ruly Challenge

Armed with this easy-to-digest knowledge of retirement planning, I challenge all of you to run some quick calculations on your own retirement planning.

If you are currently in the process of saving for retirement:

- Sit down and think about how much you really need in retirement. You might look at your budget today and determine which expenses you will still have in retirement and which might be lower. Given your health and genetics, how long could you possibly work a full-time job? Could you afford to stay in your current home? How much do you think medical care will be? Do you think you will receive Social Security or a pension? If yes, about how much? Based on this planning, come up with a number in today’s dollars that is your desired annual income in retirement and figure out how much you are counting on from the government and/or pensions and the amount you will need to save yourself.

- Get an estimate of the total amount you need to save by retirement based on your income requirements in #1. You can use this simple calculator (remembering to factor in your estimated tax rates) or one from your own 401(k) or other financial provider.

- Determine how much you need to be saving each month using a calculator such as this one or this one for 401(k) participants. If you already have some money saved, you will put the current value of that savings in the “Present Value” column. The number you calculated in #2 above goes in the “Future Value” column. Print out the schedule for reference and plan to check in on your progress at least once a year to make sure you are staying on track. If you are truly unable to save anything at this point in time, figure out an estimate of how much you will need to be saving once you reach a point of financial stability.

If you are already in retirement:

- If you are depending on a pension or Social Security, do a quick Google search to find out the current financial status of the pension or consider setting up a free Google news alert for the name of your pension plan to stay on top of developments in this area.

- Try a calculator like this one to make sure withdrawals from your own savings are on track.

- Develop a contingency plan in case your income is decreased.

What have you learned about retirement math? Are you overwhelmed or empowered knowing the above information? Please share in the comments.